You can divide in Excel using a formula such as =1500/12. For a monthly budget, divide the total average yearly cost of a large bill by 12. Things like medical bills, home repairs, and car repairs can be budgeted ahead of time so that you have the money when you need it. Nobody makes it through life without unexpected big bills. This would also be a place to pull out priority savings to apply the "pay yourself first" principle. If you pay a tithe (the "pay God first" principle), then you can multiply by a percent in excel using a formula such as =10%*B9 where B9 is the Total Income. This category is for making adjustments to your gross income, such as listing the tax withholdings and other deductions from your paycheck.

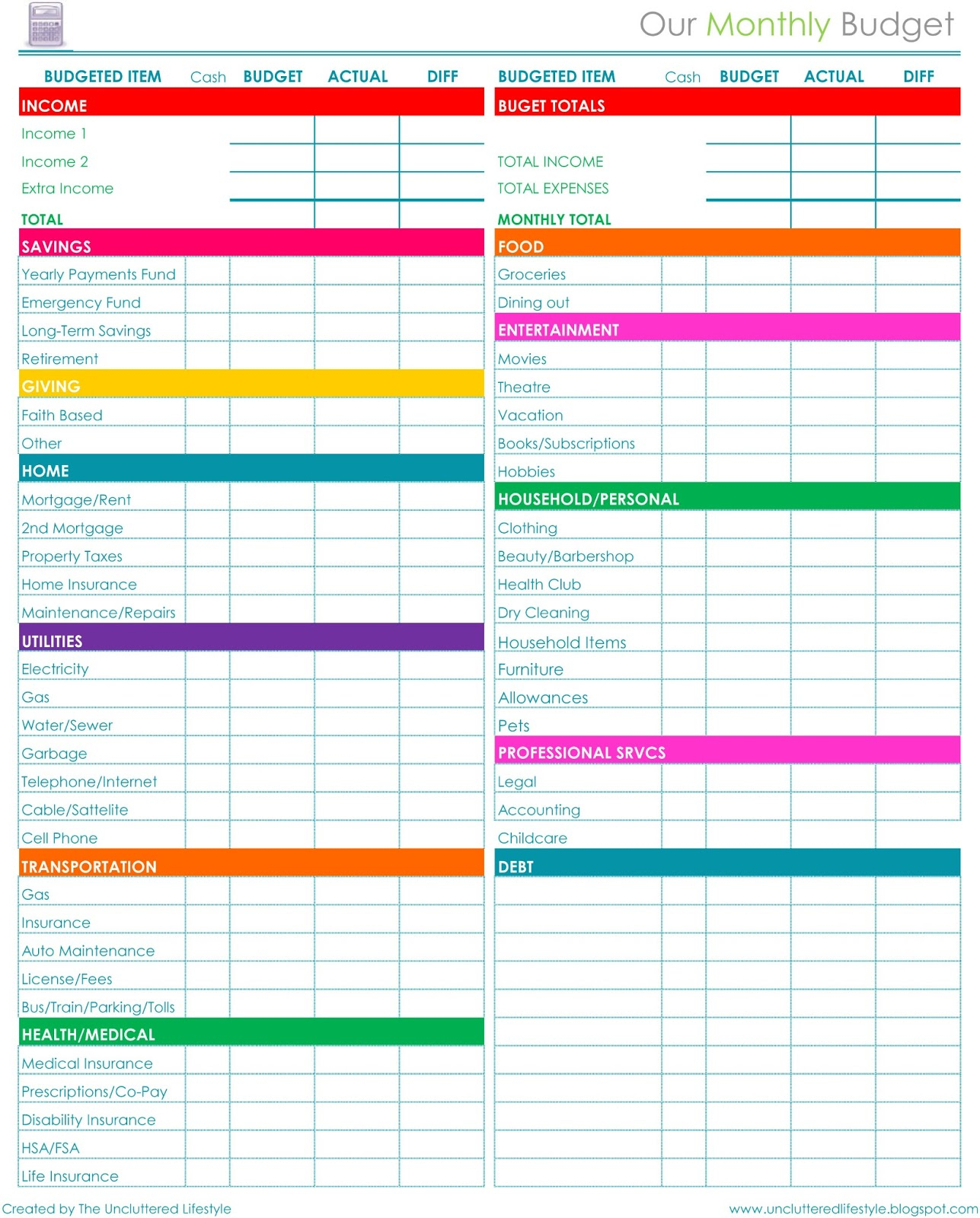

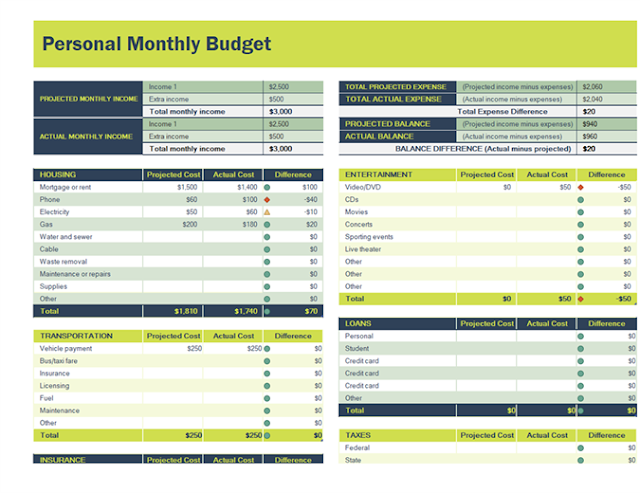

They are designed to help you apply the 'Pay God First' principle, the 'Pay Yourself First' principal, the 'Debt Snowball' and 'Savings Snowball' techniques, the 'Sinking Funds' idea, and the 'Envelope Budget' system. The categories in this worksheet have a very purposeful structure. Step 2: Enter Your Budget (Savings and Expenses) If your income varies a lot, you can base your budget on what you expect the minimum for the month will be. If you get paid weekly, you can base your budget on 4 weeks. If you actually get paid biweekly, you may want to base your budget on just two weeks of pay, then use your extra paycheck twice per year to do something special. I am sorry for not writing the formulas here, but you can figure them out after going thru below send it to me, if it is something generic, I can share it with our members this is an awesome tool, thank you once is a good idea, we can attempt it in another post.If you are creating a monthly budget, list all sources of income for the month. A5,B5,C5, we can use vlookup to fetch the actual period then use that period in SUMIFS or SUMPRODUCT to find the actual amount that is due. Assuming the creditcard name, billing start date and billing end date (just the date, not month or year) are in cells A1,B1,C1. Go here: That should be a bit tricky, as each credit card will have its own billing cycle. Novemat 12:16 Can you ask any questions not related to this post in our forums, that way more ppl can see your question and help you.

PS: I have edited original files Sovan e-mailed me, to make them compatible with Excel 2003. If you have enjoyed these templates, please drop a thank you note using comments. I thank Sovan for sharing these workbooks with us. It is always inspiring to read mail from our members and learn about various interesting ways they are using Excel.

PERSONAL BUDGET EXCEL SPREADSHEET FREE DOWNLOAD

Sovan built on this concepts and developed an expense sharing worksheet that you can use.Ĭlick here to download the expense sharing excel file.

PERSONAL BUDGET EXCEL SPREADSHEET FREE HOW TO

In tracking and sharing expenses using excel post, we have described how you can use MS Excel to findout how to share expenses among your friends or colleagues. Sharing Expenses among Friends using Excel Download the household budget spreadsheetĬlick here to download the household budget excel file. Again, another technique from Sort and Display chart data automatically post. In this, the expenses are sorted from highest to lowest and grouped by category. There is an “analysis” worksheet where you can see some graphs based on your expenses. For this, Sovan uses Conditional Formatting.

You can also highlight expenses above certain pre-defined amount. Sovan uses the circular reference formula technique we described in that post. As you enter the expense, the time stamp is automatically generated (read automatic timestamps in excel). Using this spreadsheet, you can track your expenses. So here they are, Household Budget Spreadsheet I immediately asked him if it is ok to share these files with our community and he is more than happy. Naturally I got excited to see such prudent use of excel. Sovan, one of our blog readers from Chennai, India, sent me 2 excel budgeting spreadsheets. But I am here to tell you fun ways to track expenses and household budgets using spreadsheets. So when we got our first job (did I tell you that both Jo and I started working in same company and sat in same floor? Oh, it was such a lovely time), we were very prudent and decided not to waste money on anything trivial (we still are, just that over last 6 years our earning capacity increased a bit and we became parents).Īnyways, I am not here to bore you about my household. Our upbringing has taught us value of money in the most effective way – by exposing us to not having any. PHD and I come from very modest backgrounds. At PHD household, we believe in using money wisely.

0 kommentar(er)

0 kommentar(er)